RMRK Royalties and Game Theory: Featuring Vampsy

Royalties are a recent hot topic with RMRK 2.0 migration on Singular, where artists can now set their royalties and receive residual income for every trade in their collection, even after the initial sale.

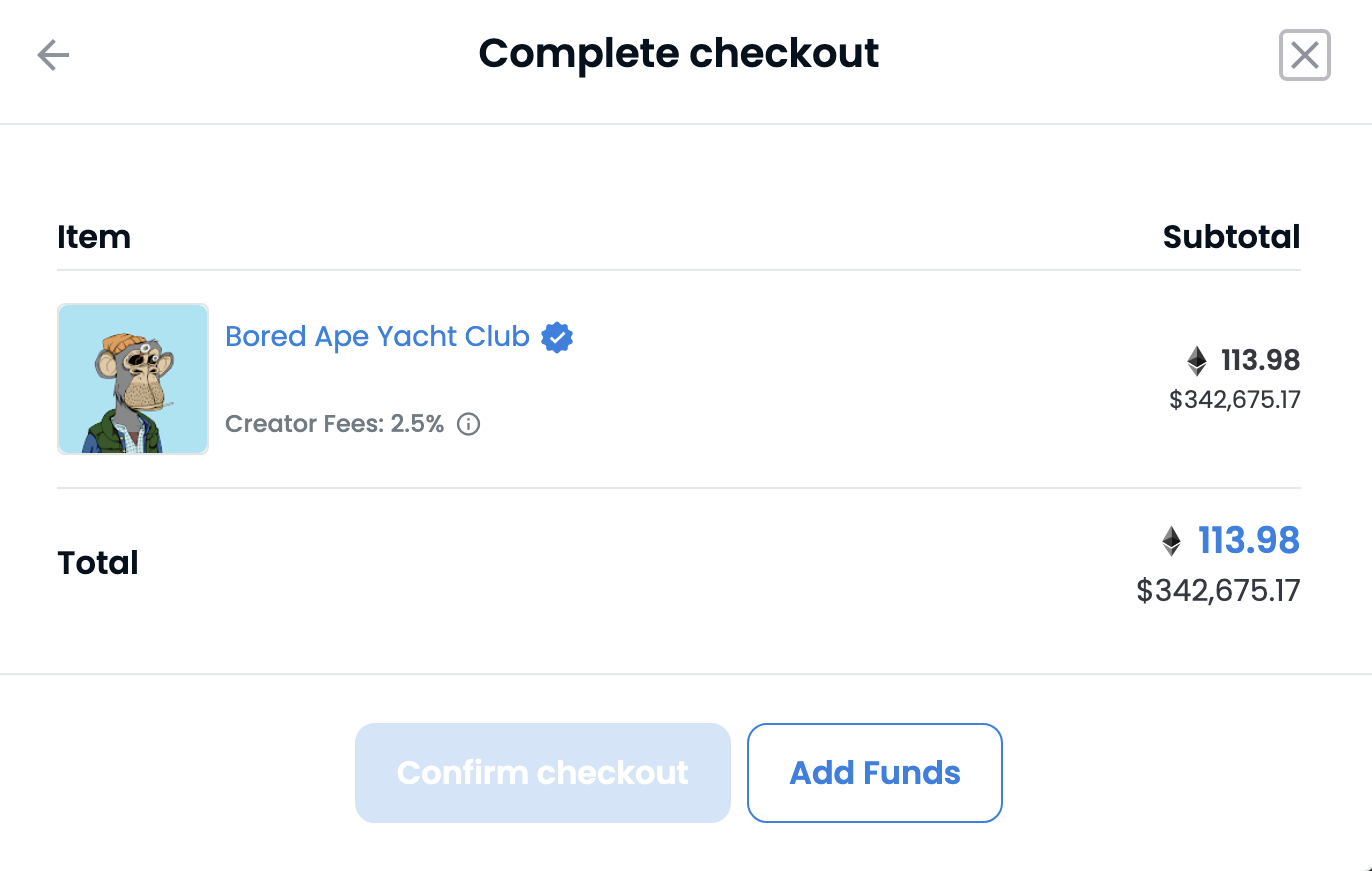

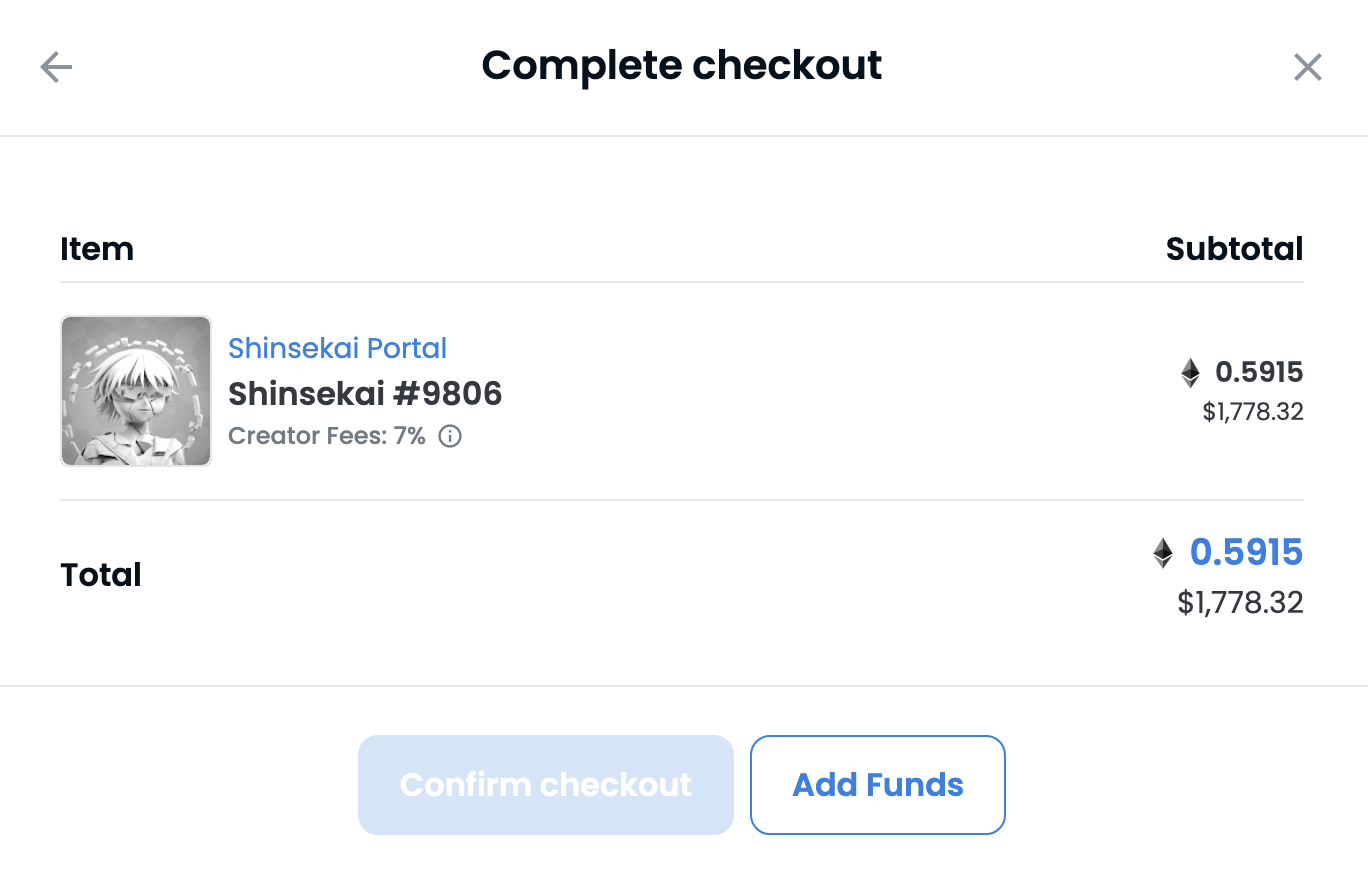

On other chains, early collections felt that 2.5% was fair, whereas more recent collections are charging upwards of 7%.

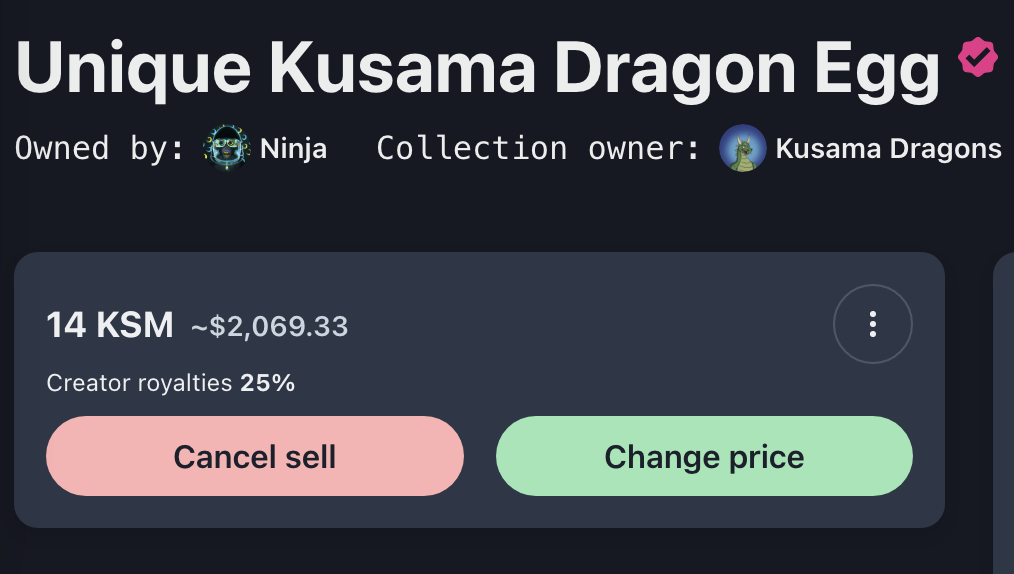

Older collection

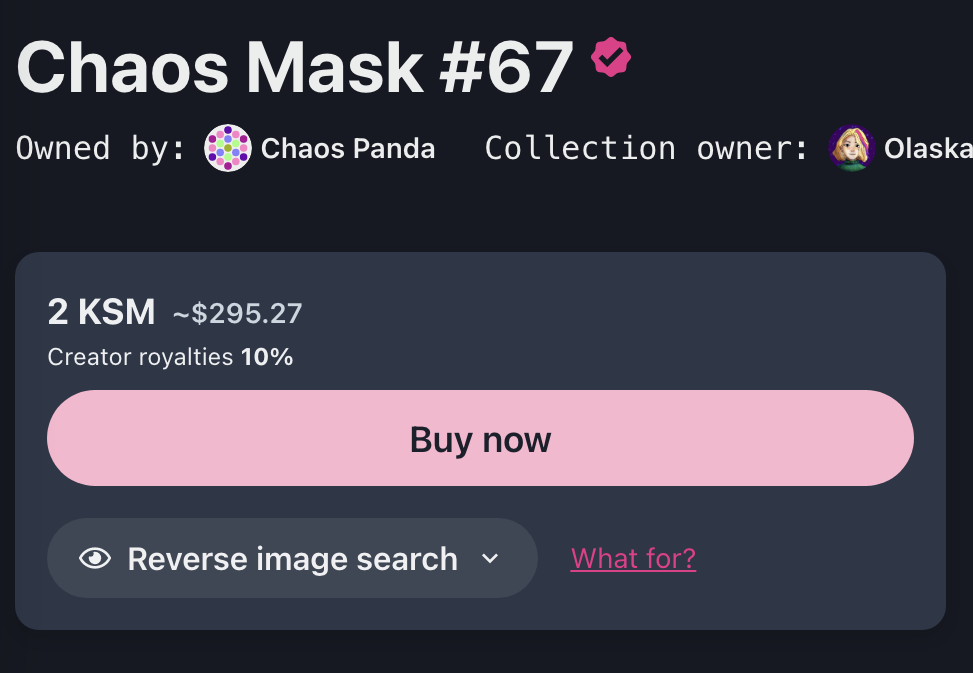

Newer collection

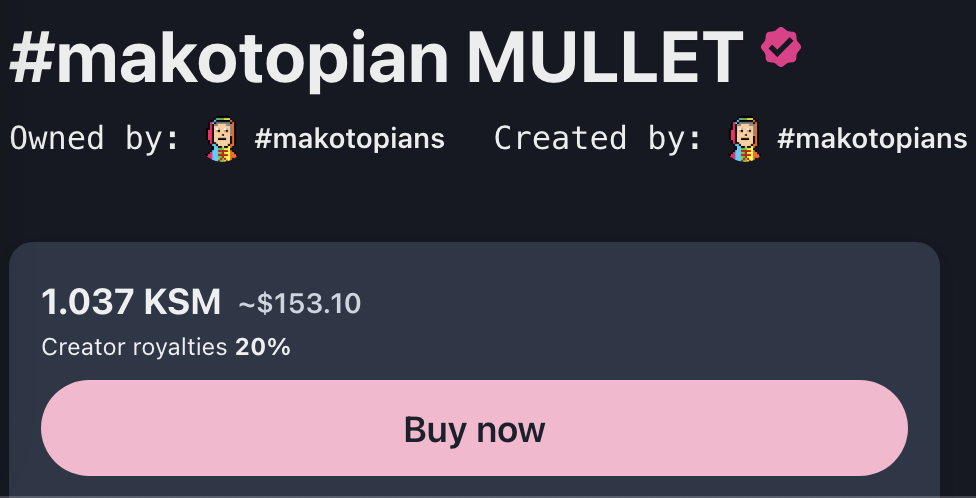

But on Singular, many--if not the majority of artists seem to be moving towards a 10% or more royalty rate.

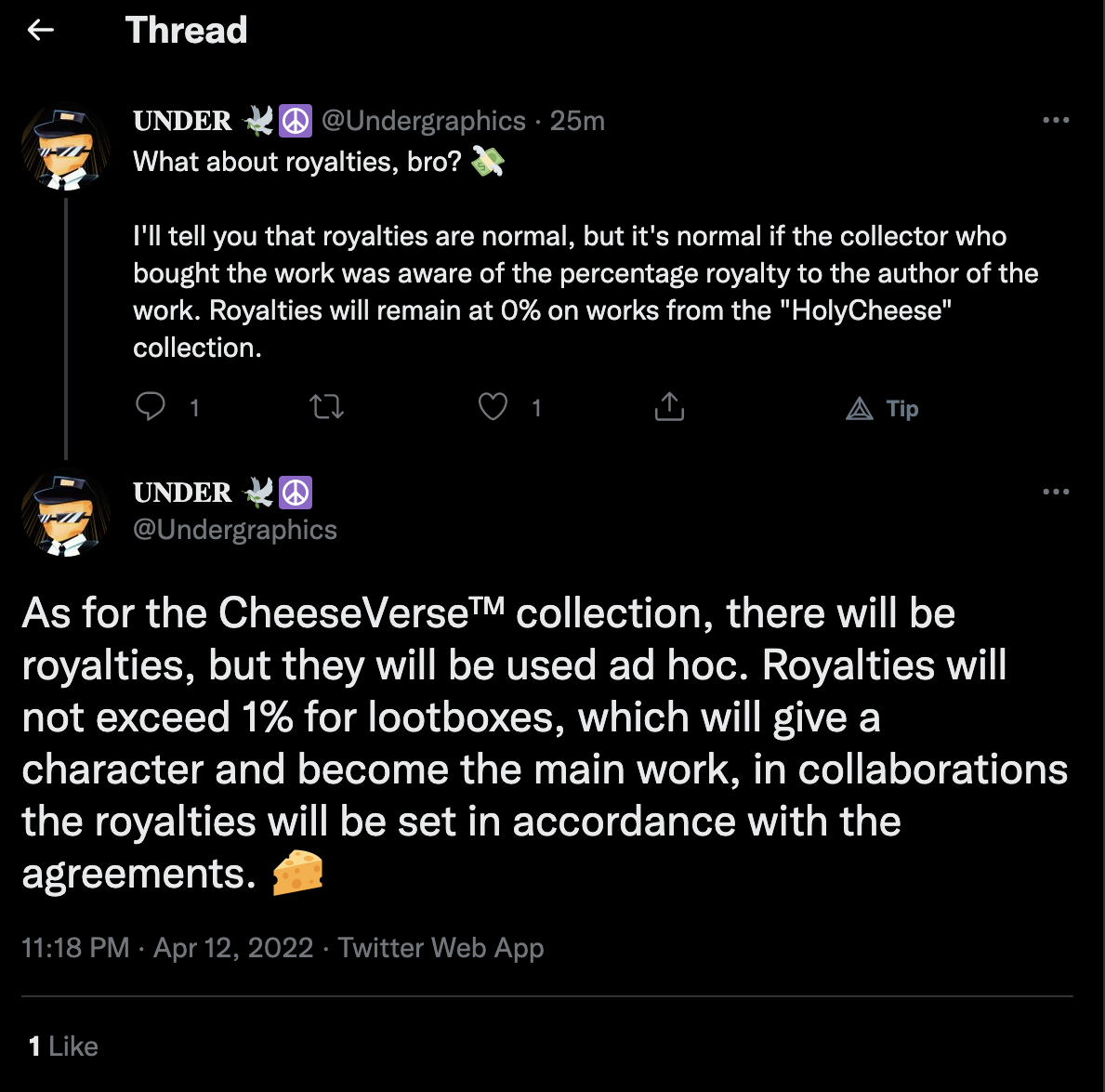

That said, there are also artists taking a very strong stand against the trend:

Whatever your opinion, royalties are groundbreaking for artists because it means that they can gain passive income, enforced by blockchain, and potentially grow to a size that allows them to live off that passive income if they are creative, persistent, and talented enough.

Prior, when artists only made income from the initial sale, there was a problem: Traders may have flipped their collections, often times at multiples above the original price.

While natural, this can lead to abandoned collections as artists will frequently choose to create new pieces, rather than reinvest time and effort into their old collections.

This affects investors, holders, the most.

They purchased, placing their faith in the artist that there would be long-term value built from the collection, but when the artist moves to a new collection, the investor may feel frustrated at the artist as they are left "holding the bag", thereby affecting the artist’s long-term reputation.

Essentially, prior to shared royalties, artists are the only ones "guaranteed profit" (deservedly), and traders have been getting high-value flips, while investors have frequently lost money because abandoned short term prospects may never rise again.

The blessing of royalties is that they can incentivize continued further development of already released collections.

…at least on the surface.

Vampsy, advisor for Chaoz-sama, is a game theory economist. He wrote this piece to describe some of the incentives of the current royalty structure, and he offers alternative ideas. Throughout the article, I am adding in my own thoughts, and TLDRs.

NFT Royalties: Preliminary Discussion of Current Problems and Potential Solutions

-By Vampsy

Note: All of these forms are commonly used around the world in a variety of licensing situations.

That Collectors deem the Creator’s rate to be “too high” could just be reflected in a lower price on the Creator’s initial sales.

There are various alternative royalty structures that can fix the problems, or at the very least, align Creator-Collector incentives. In this article, I discuss two alternatives that involve just one change to the current structure. (There are additional ways that can help align incentives, with and without changing the royalty structure. I am also not claiming that the royalty structures below are the best ones, it just illustrates how one small change to the current structure can align incentives).

NFT royalties payable to Creators can be beneficial for Collectors as it incentivizes the Creator to continue making efforts to increase the value of the collection after the initial sale. The higher the royalties, the higher the motivation. Royalties can take on different forms, like percentage of price, fixed amount per sale, and/or lump sum, and features like royalty caps, floors, discounts, surcharges, etc. All of these forms are commonly used around the world.

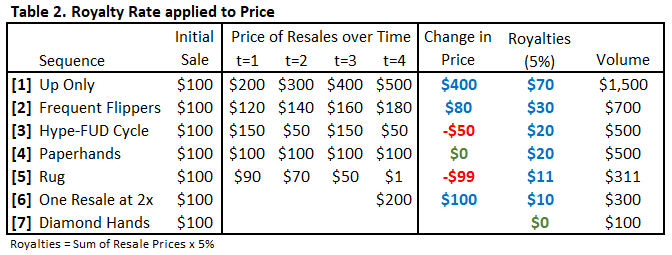

The NFT industry so far has implemented one specific royalty structure: A fixed percentage rate is applied to the price of all resales.

With a percentage royalty rate, both the Creator and Collector benefit when the resale price increases. “High” royalty rates, in and of itself, are not necessarily bad, and in fact, can be good for Collectors, as long the royalty structure is designed appropriately. To the extent that higher royalties entice higher efforts by Creators that lead to greater increases in resale price, Collector resale profits may turn out to be higher with higher royalty rates.

The current royalty structure used in the NFT industry, however, has a significant problem because it makes it so that the incentives of the Creator are not aligned with that of the Collectors.

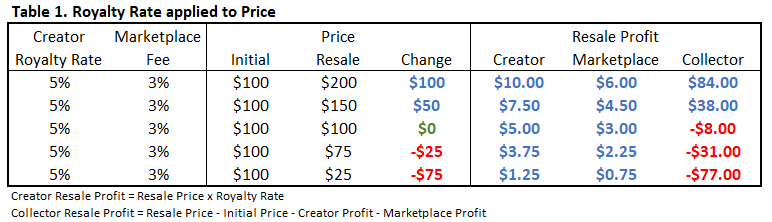

Table 1 illustrates two problems that arise in a one-time resale under the current structure. First, the Creator makes money when the Collector loses money. Second, and relatedly, the royalty amount is not aligned with the value-added since the initial sale – for example, Creator royalties are not too different with an increase in value of 50% vs. no change in value. (The example in Table 1 uses a 5% rate as that seems to be relatively common, but these observations hold with any other positive royalty rate applied to the current structure).

Table 2 illustrates the bigger problems that arise with a sequence of resales over time.

As shown in Table 2, all looks fine during the Up Only period but what happens when that inevitably ends? The Creator stands to make more royalties by taking actions (or non-actions) that increase volume, even at the expense of decreasing the value of the collection. In this example, the Creator gets much more in royalties with the Hype-FUD and Paperhands sequences, even though there is no increase in value, versus One Resale at 2x (3 and 4 vs. 6). In fact, a rug can even generate about the same / more royalties than with One Resale at 2x / Diamond Hands (5 vs. 6 and 7).

As illustrated, the current royalty structure creates a conflict of interest. Creator royalty profits depend on resale volume whereas Collector resale profits depend on the change in price. To the Creator, any resale is better than none. The Collector absorbs all the losses when the NFT value goes down but shares the gains with the Creator when it goes up.

Simply lowering the royalty rate does not solve the problem – a lower rate gives Creators less incentives for bad behavior, but it also gives them less incentives for good behavior. Also, to the extent that Collectors deem the Creator’s rate to be “too high”, that could just be reflected in a lower price on the Creator’s initial sales

Collectors can simply lower their willingness to pay or not buy at all.

TL;DR

The standard model is a fixed percentage rate to all resales. This means that in some cases, Creators are actually incentivized to create volume, even at the cost of their collection value. Imagine a Creator releasing "fake news" to FUD his own collection, thereby making more money in an easier way than increasing the value of the overall collection.

Here, Vampsy brings up a poignant discussion point. The common complaint about traders and investors in the old model is that "Traders don’t even do anything. They just make money off the artists’ backs."

However, this line of thinking disregards the risk that investors and traders are taking, because unlike artists who can only net profit (even if minuscule), a trader and investor can lose not only some value, but all value.

This comes back to the old adage, "No risk, no reward."

A trader argues that their risk of going to zero justifies the high reward of flipping the NFT for a much higher price.

Meanwhile, this is a very clear reason why the highest risk is actually to investors who do NOT plan on flipping. These investors are willing to take the bet that in the long term, the artist and the collection will increase in value—which is simply said, a far less likely scenario than a short term price pump that a trader would take advantage of.

What this means is that long-term holders tend to be the ones who lose the most value.

There are various alternative royalty structures that can fix the problem, or at the very least, align Creator-Collector incentives. I discuss two alternatives below that involve just one change to the current structure. (There are also other ways that can help align the incentives, with and without changing the royalty structure. I am also not claiming that the royalty structures below are the best one, it just illustrates how one small change to the current structure can align incentives).

Two alternative royalty structures that align incentives is to assess royalties as:

(1) A fixed percentage rate applied to the CHANGE in price of all resales; or

(2) A fixed percentage rate applied to the INCREASE in price over the historical all time high of all resales for that NFT.

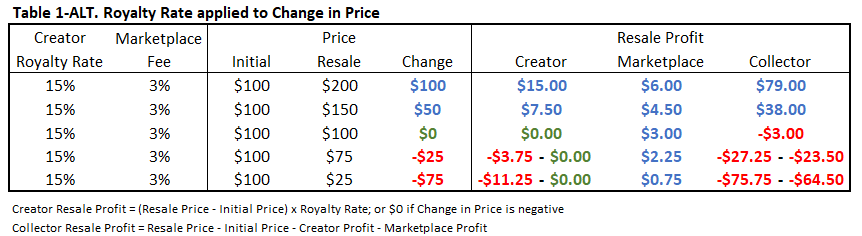

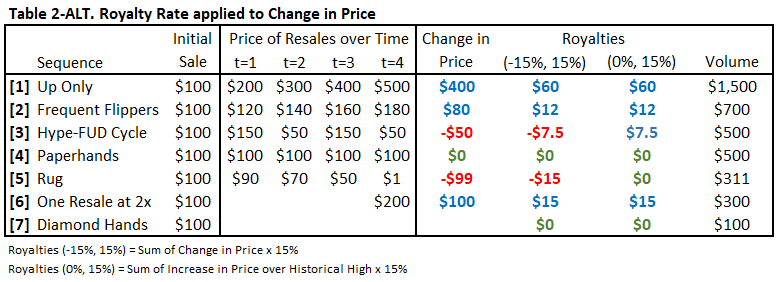

Table 1-ALT and Table 2-ALT revise Tables 1 and 2 with these two alternative structures and increases the royalty rate to 15% (to make the top two resale profits for the Collector similar / same as Tables 1-2).

With the first implementation, labeled (-15%, 15%) in Table 2-ALT (and also illustrated in Table 1-ALT), the incentives are fully aligned – the Creator and Collector share the gains / losses with symmetric royalty rates from both the upside and downside. When the price goes up, the Creator gets 15% in royalties, and when the price goes down, the Creator returns 15% in royalties. In this way, the Creator is motivated to increase the value of the project (like with the current royalty structure) but is also less motivated to exploit Collectors as the royalties from rugging or from a decrease in price are negative (not positive, like with the current royalty structure).

One way to implement negative royalties is to lock Creator royalties in an external account so that if there is a resale with a decrease in price, a portion of Creator royalties will be reimbursed to the Collector. In the meantime, as long as the NFT is not resold for a lower price, the Creator can continue earning interest / staking rewards on the locked royalties.

The royalty rates also need not be symmetric on the upside and downside. For example, it could be (positive) 15% on resales when the price increases but (negative) 7.5% or even 0% on resales with a price decrease – the incentives would still be more aligned than with the current structure, although it would be weaker than with negative royalties.

In another case, rather than a potential negative royalty, the Creator is only able to earn money on an increase in price over the historical high.

This second implementation, labeled (0%, 15%) in Table 2-ALT (and also illustrated in Table 1-ALT), considers asymmetric royalties to account for the possibility that it may not be practical for some Creators to pay back royalties to the Collector. In this implementation, the Creator earns royalties only on the increase in price over the historical high. For example, if the resale price sequence is $100, $170, $150, $200, the Creator would earn royalties on the first resale, ($170 - $100) x royalty rate, and the third resale, ($200 - $170) x royalty rate. In this way, the royalty floor for the Creator is $0, thereby avoiding negative royalties.

A better alignment of Creator-Collector incentives and payoffs with the alternative royalty structures above benefits Collectors as it motivates the Creator to act more in the interest of the Collector, which, in turn, also benefits the Creator with higher demand for the collection (and therefore, higher prices and / or sales quantities). In addition, note that having to pay back some royalties in the future is not necessarily a net loss to Creators as a commitment to do so can increase value to Collectors and increase demand for their collection, leading to higher prices and sales in the first place. Just as a royalty structure that does not align Creator-Collector incentives can reduce value and prices, a well-structured royalty can increase value and prices.

Vampsy is proposing two possible models.

In one case, the Creator is bound to receiving royalties that are locked or held, and the royalties can have deductions against it in the case of a falling price.

In the other case, rather than a potential negative royalty, the Creator is only able earn money on an increase in price.

While alternative model one might arguably be more "fair" I believe it to be unrealistic. It’s true it keeps the incentives aligned, however artists would rather leave than deal with such an aggressive model that can penalize them for "failure". To me, it doesn’t cultivate the nurturing environment that I believe artists to need.

Vampsy responds:

Artists don't need to implement this structure if they don't want to, they can just do % of price like now. I expanded with insert above about how committing to this can generate more profits for them --- whatever creates value to Collectors, some will flow back to Creators.

Also, the royalties would be locked, so if they leave and rug and price goes down a lot, artists have to pay back the locked royalties. The positive royalty is the carrot and the negative royalty is the stick, both mechanisms work together to keep incentives aligned in that the creator is motivated to keep working to gain royalties and not lose them. Also, the negative can be a lower rate than the positive as mentioned to make this softer. Is really unrealistic?

After going through these, I have a few reservations.

For instance, in alternative model two, while seemingly fair, makes me wonder about possible manipulation. While this is not traditional art, money laundering is quite common in traditional markets--so it is a question of how this might extend to NFTs. Would incentives that could improve the returns a money launderer (or even the legal tax loss harvester) motivate them to continue using the art as a tool, or is this all more mainstream media FUD that shouldn't shape our systems at this stage?

Whatever the case, lower costs (or no costs) is always something to consider when dealing with bad behavior.

Additionally, if the difficulties are too "insurmountable", like reaching a new all time high on your pieces, it can demotivate creators earlier than other royalty models if the collection's price has dropped significantly.

And finally, with a treasury of locked royalties, we have to keep in mind potential security issues if it turns out to become a honeypot.

Whatever the case, Vampy’s next model below is interesting and seems to me one of the most "fair" models that would result in the least amount of friction.

As a first step towards aligning Creator and Collector incentives and exploring the use case of NFTs as a true store of value art, Chao-sama is introducing an experimental set of Chao NFTs in which 50% of the initial price is locked in an external account. The Collector who owns those NFTs can return the NFT at any time in the future to receive 50% of the initial price, thereby ensuring that at least 50% of the price paid is actually “stored” in the NFT. Chao-sama is, in concept, implementing a specific version of the negative royalties described above. Chao-sama is incentivized to put in efforts to ensure that the value of the collection never drops by more than 50% and the Collector is ensured that the worst outcome is 50% of price paid rather than $0.

The Chao-sama collateralized NFTs is a first step in the path to align the incentives of Creators and Collectors (at least partially) and to introducing a true store of value feature in that at least 50% of the initial price is actually “stored” in the NFT and redeemable at any time.

This model with Chaoz-sama is a shared risk model where Collectors are guaranteed to be able to redeem their NFT at 50% of the initial price should the floor drop below that. In other words, it limits downside to 50%, rather than to 100% losses.

Ultimately, in this case, both the collector and the creator loses when the price drops significantly. This is very similar to the first model, except that it is done through collateral rather than what can be seen as "punishment" for circumstances often outside the artist’s control.

Vampsy adds an additional note, however:

"One thing that I didn't go into too much detail on that might be good for ppl to hear is:

With a percentage royalty rate, both the Creator and Collector benefit when the resale price increases. “High” royalty rates, in and of itself, are not necessarily bad, and in fact, can be good for Collectors, as long the royalty structure is designed appropriately. To the extent that higher royalties entice higher efforts by Creators that lead to greater increases in resale price, Collector resale profits may turn out to be higher with higher royalty rates.

Collectors seem to get too fixated on reducing their costs; and creators seem too fixated on charging more... without considering their circumstances.

Here's an example:

Ultimately, what matters is profits, not costs. For example, suppose that a high royalty rate, like 10% (on price) for example, is going to entice the Creator to put in a lot of effort that leads to an increase in the value of the collection 2x from $100 to $200, whereas a low rate like 2% is only going to entice them to put in minimal effort that only leads to a 20% increase. Then Collectors are much better off paying a higher rate, as resale profits are: $200 - $100 - $200 x 10% = $80 with a 10% rate vs. $120 - $100 - $120 x 2% = $17.60 with a 2% rate.

Have we come full circle? Maybe the incentive with a higher collection price, with a higher royalty, will incentivize artists to put more effort and add value to their collections long term.

I think this is entirely plausible, and simple.

Another writer suggests that the answer is even more straight-forward: Have the artist hold 5-10% of their own collection and do with it as they will (though that begs the question: what happens if the artist sells?).

I AM a believer that the simplest answer is often the correct answer.

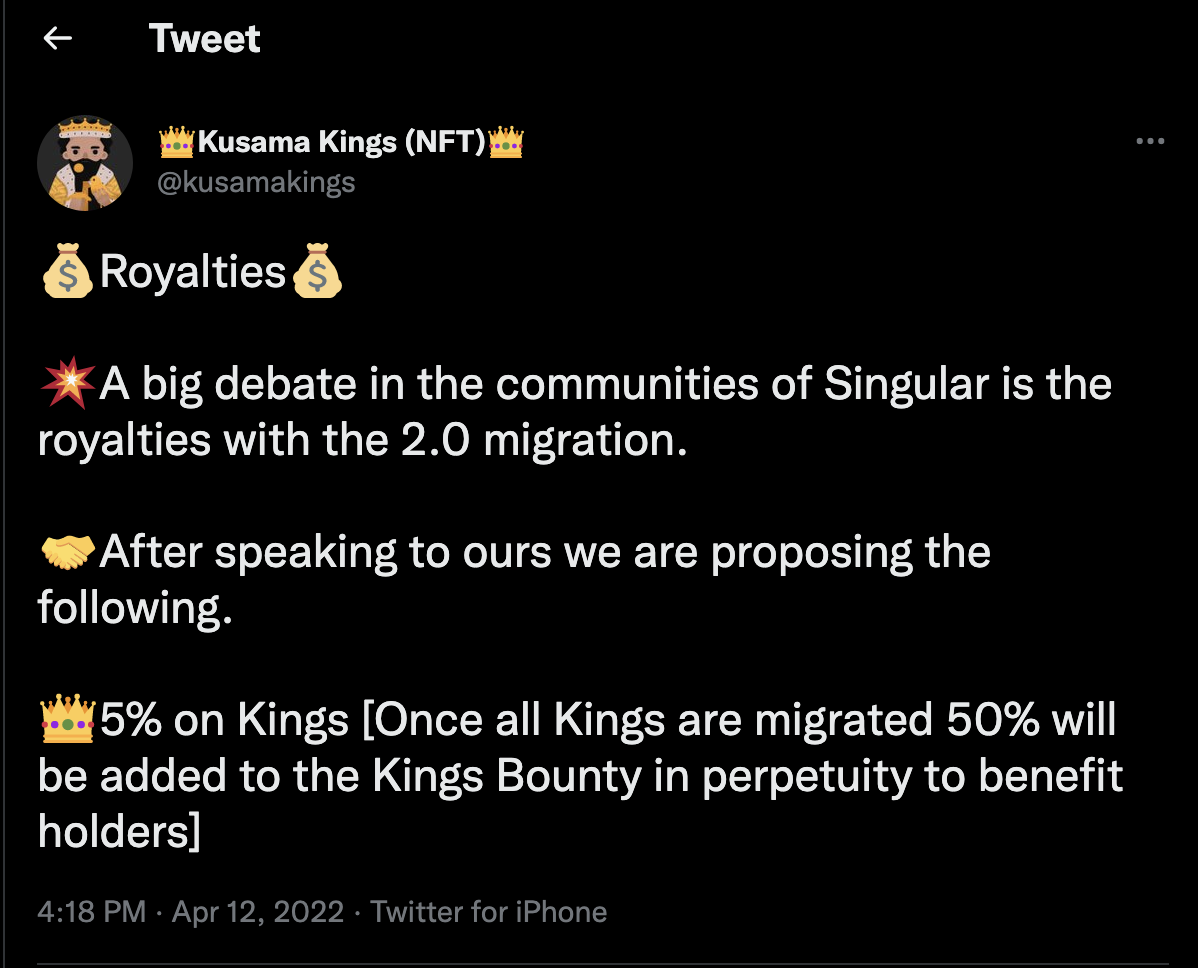

Finally, I want to direct attention to a recent announcement by the Kusama Kings, in which the Royalty Fee is 5%, but 2.5% of the royalty fees will be returned to the community.

This is another simple way to align incentives between Creators and Collectors, and perhaps a much easier model than any of the above discussions.

Whatever the case, I certainly want to know your thoughts.

HUGE thanks to Vampsy twitter: @vampsyfear for all his thought and presentation in this article and associated Wag Media Video linked here: https://www.youtube.com/watch?v=26to_je66v0

Consider sending KSM donations for this article here: D8WrK1jsFy9zpFwFZStaDTmX32pMZVdwXTm5rt9LsRKBQrz

KSM/DOT Enthusiast

The discussion place for RMRK.app based NFTs. Official announcements and community discussions.

0 comments