vETH/WETH Stable Pool has been officially launched on Aura Finance

Since Balancer’s Composable-Stable Pools market-making algorithm is applicable to correlated token pairs like vETH/WETH, Bifrost Team has migrated the vETH/WETH liquidity pool to Balancer.

On May 26, our vETH/WETH Stable Pool reached $1,623,360 TVL and accumulated $2,877,586 Volume on Balancer. Users can add both vETH and WETH to the pool to provide liquidity, or provide only one of these assets: vETH or WETH.

vETH/WETH Pool Address:

https://app.balancer.fi/#/ethereum/pool/0x793f2d5cd52dfafe7a1a1b0b3988940ba2d6a63d0000000000000000000004f8

Benefits of staking LP token

Users get the liquidity credential BPT for providing liquidity on Balancer. Providing liquidity to the vETH/WETH pool yields the BPT-vETH/WETH. Holding this BPT ensures users to continually receive swap fees from swaps done on the vETH/WETH pool. On top of that, users can stake it for further gains. There are currently two stake paths:

- Stake the BPT-vETH/WETH on Balancer to get BAL gain. We provided a brief Tutorial to explain the process, here: vETH/ETH Liquidity Farming is Live: Details, Incentives & User Guide

- Stake BPT-vETH/WETH on Aura Finance to receive both BAL & AURA rewards.

Of these yield options, a single BPT-vETH/WETH cannot be staked on three ways simultaneously. The overall yield of staking with Aura Finance is higher than the other option.

Providing Liquidity on Aura

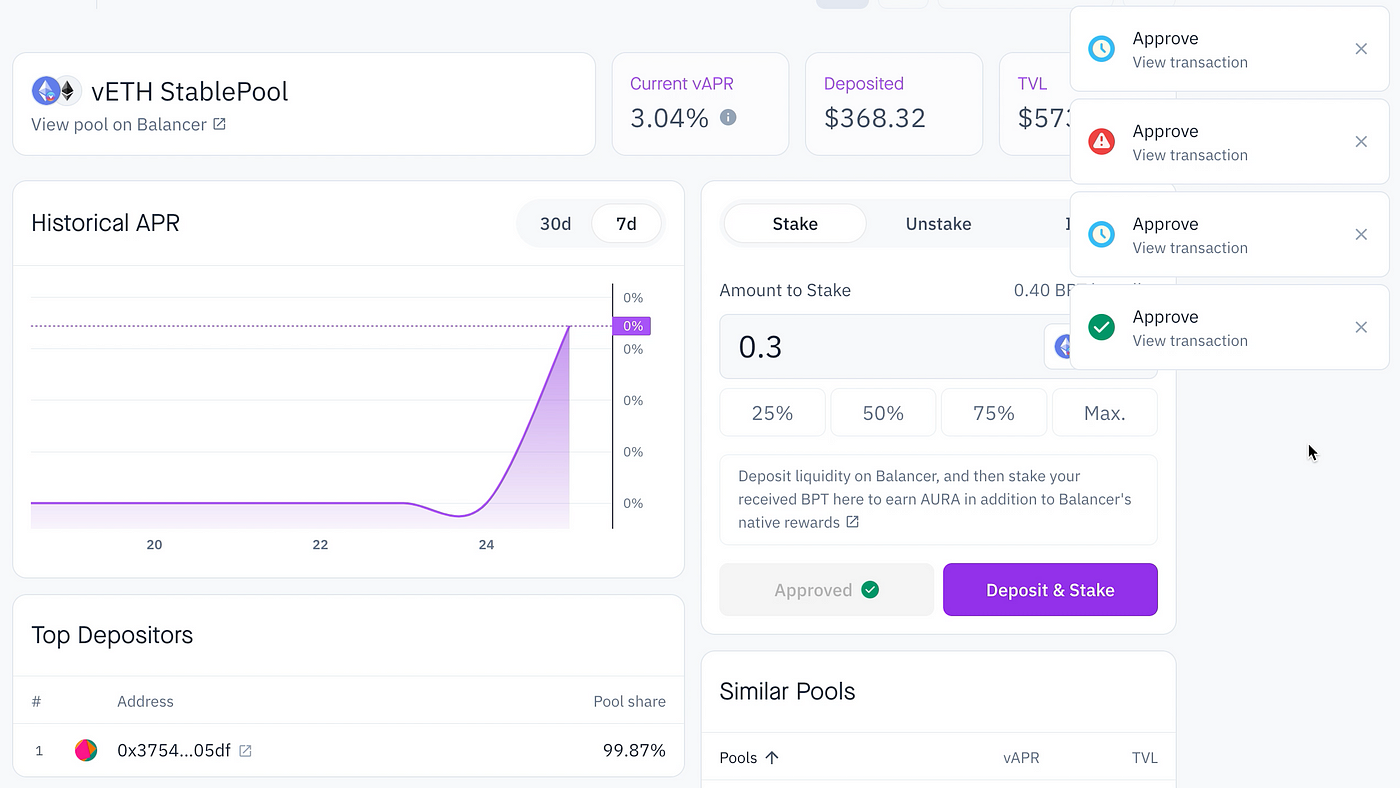

After providing liquidity to vETH/WETH on Balancer, users receive the BPT-vETH/WETH. Then, it is possible to stake BPT-vETH/WETH on Aura Finance. See the following steps:

- Step 1: Open the link and connect your wallet https://app.aura.finance/#/pool/96

- Step 2: On the right side, choose BPT to provide liquidity.

- Step 3: After entering the number of Tokens provided, click Approve to complete the on-chain signature

- Step 4: Click Deposit & Stake and deposit the liquidity in vETH/WETH Stable Pool

Video tutorial:

https://twitter.com/BifrostFinance/status/1664579654370603009?s=20

Balancer & Aura’s Gauge voting mechanism

Gauge voting is a unique governance mechanism invented by the stablecoin exchange protocol Curve. It is now widely used in the liquidity incentive process of the DeFi protocol. Balancer currently also uses the Gauge voting mechanism, with Balancer rewarding LPs with $BAL, but the weight of these rewards differ for each transaction to the pool. The rewards depend on how many veBAL shares each pool receives for each Gauge vote.

Aura Finance also uses the Gauge voting mechanism to determine how to allocate veBAL in the protocol vault. The number of votes cast on Aura’s governance pass, vlAURA, determines which pools to vote veBAL into, and vlAURA users can earn voting revenue from the Gauge pool.

If users have $AURA in their hand, they can lock $AURA to vlAURA and participate in the next rounds of Gauge voting by following the interface: https://app.aura.finance/#/lock

There are various ways for pools to compete and get more votes in Gauges. In addition to buying or borrowing $BAL from the market and converting it to veBAL, voting incentives can be used to encourage veBAL holders to vote for the pool.

Bifrost launches voting incentives on Aura

To boost vETH/WETH yields, Bifrost also offers significant voting incentives that will be split between alAURA holders who vote for the vETH/WETH Pool in Aura Finance’s Gauge votes. In the first round of Aura Finance’s Gauge voting, Bifrost has offered $5,000 worth of ETH as a voting incentive, which will be given to vlAURA users who vote vETH/WETH.

The next round of Aura Gauge voting will open on May 25 at 2 am UTC on Aura Snapshot, and users will be welcome to vote for vETH/WETH using your vlAURA and then earn multiple benefits.

- Aura Snapshot Gauge Pool Voting: https://snapshot.org/#/gauges.aurafinance.eth/proposal/0x18c1b955920405478fe1467f015fa1fd203b51aa4f1c9970d34d47d492b33922

- vETH/WETH on Hidden Hand Voting incentives:https://hiddenhand.finance/aura

Conclusion

Deep liquidity on vETH is essential to the vETH product experience. Whether providing BNC incentives directly or leveraging more $BAL and $AURA advantages through voting incentives, Bifrost’s goal will always be to ensure deeper liquidity.

In this process, Bifrost also will allow vETH users to earn excess revenue.

If you hold vETH, you can earn swap fees through LPs and the primary staking revenue. On top of that, you can also get additional benefits, including $AURA incentives, Aura protocol share, and Bifrost voting incentive.

The final combined return can then be quite significant, far beyond the various other ETH LSD protocols available on the market, at the moment.

Bifrost Community Lead

Bifrost is a Liquid Staking app-chain tailored for all blockchains, utilizing decentralized cross-chain interoperability to empower users to earn staking rewards and DeFi yields with flexibility, liquidity, and high security across multiple chains.

0 comments