Use cases and solutions that generate real demand for the ASTR token

Tokenomics is one of the most fascinating topics in the crypto community as it determines the fundamental rules for each project. However, it is crucial to carefully analyze the applications and uses of each blockchain or dApp so that the tokenomics strategy adopted by the project team is coherent, whether it’s inflationary or deflationary.

There is no standard formula since different projects with different applications require distinct approaches.

The tokenomics equation consists of two crucial variables: supply and demand. Usually, projects detail how they plan to make their tokens available in the market. Still, they often face challenges in addressing the second part of the equation (demand) as each case is unique and complex.

Finding an effective strategy to drive demand for a token involves considering various factors, such as the token’s utility within the project’s ecosystem, community interest, strategic partnerships, and other specific aspects that can vary from project to project.

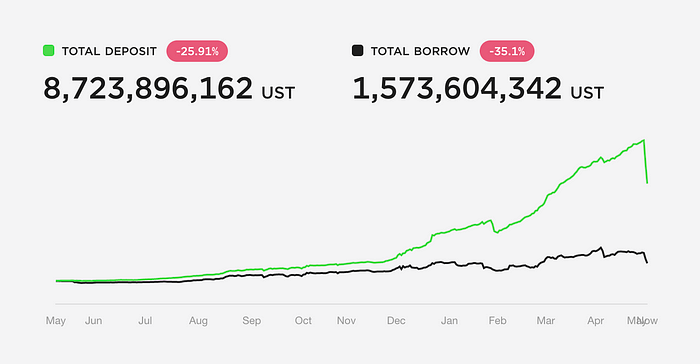

Many projects use tokenomics as a tool to incentivize certain user behaviors. The collapse of UST is an example that illustrates how it’s possible to create an illusion of a market economy. In this case, around 80% of the token’s supply was locked in the Anchor protocol, resulting in high returns and unsustainable annual interest rates (APR). Unfortunately, the tokens were not intended for real and practical uses but ended up being held in staking as part of a scheme resembling a Ponzi scheme.

It’s essential to highlight that projects with poorly conceived tokenomics practices may attract investors with promises of high returns and benefits, but they end up creating an unstable and unsustainable situation in the long run. The true use of tokens should be focused on real use cases that add value to the project’s ecosystem, rather than promoting schemes that only generate temporary profits without solid foundations. An ethical and responsible approach to tokenomics design is crucial to ensure sustainability and investor/user trust.

According to Roderick McKinley, tokenomics can be a scarce digital asset, but today, it is possible to create programmable digital tools that influence how people behave and interact with each other, often creating new possibilities for exchanges.

Within the realm of intangible “magic internet money,” it is crucial for platforms to have external and organic sources of revenue. Relying solely on new investors can be risky, and that’s where the concept of appropriate tokenomics comes into play, as opposed to “ponzinomics.” The key to sustainability is to seek external sources of revenue that come from real use cases in the industry and innovative solutions to everyday problems, creating genuine demand for the token.

By anchoring the token’s value in concrete use cases and solving real problems, the platform becomes less susceptible to speculative fluctuations and more resilient in the long term. This also increases the confidence of users and investors, as they see that the token’s value is backed by solid fundamentals.

Therefore, when developing a tokenomics strategy, it is essential to focus on creating a healthy and sustainable ecosystem driven by practical use cases and innovative solutions, rather than relying on unsustainable schemes that may compromise the platform’s credibility in the long run.

Review of Astar’s Tokenomics:

The unlimited supply of ASTR tokens and the inflation rate of around 10% have been a concern for many members of the community. However, it’s important to understand that this model is necessary to enable the existence of the Build2Earn (dApp staking) program.

DApp staking allows developers and teams to receive incentives from the blocks, i.e., inflation, to continue creating, developing, and maintaining their applications, dApps, and contracts. Assigning all costs to the most significant members (Devs) is at least shooting oneself in the foot. These innovators are the ones responsible for building and making Web3 a reality.

In Astar, inflation is used to reward collectors for maintaining the network, Devs for creating applications and services through dApp staking, stakers for locking their tokens, and to fuel the treasury for promoting activities and initiatives that enhance the network.

However, there is a consensus among the team that the inflation rate in Astar is high when compared to the target inflation rate of the US (2%), as quoted by Sota Watanabe, the founder of the project. Therefore, the team is working with external partners to define the best model for Astar’s new tokenomics.

One of the French community ambassadors highlighted that changing the tokenomics of a Proof of Stake (PoS) blockchain is a very sensitive matter, and there are groups with different interests within the community.

- Holders: Wants lower inflation rates and a delimited supply to protect their investments from value loss associated with the dollar.

- Collators, Devs, and Stakers: Wants a higher inflation rate for more income.

Two sides with opposing objectives; hence, finding the right balance is necessary.

In the last crowdcast, Astar Foundation’s CEO, Maarten, brought updates on the tokenomics studies that will be launched soon, focusing on dApp staking V3. Therefore, advanced research on how to maintain a healthy inflation that benefits developers and adds value to the ASTR token is in demand.

After more than three months of research, in partnership with specialized companies, tests, and tokenomics models have been conducted to find the ideal model. Additionally, research and comparisons with other successful L1 blockchain models outside the Polkadot ecosystem, such as Near, Cosmos, and Avalanche, have also been carried out.

The results so far have suggested:

- Reducing the current inflation

- Adjusting the allocation of rewards for builders (dApp staking V3)

- Rethinking inflation allocated to collectors

- Rethinking inflation for the treasury and its usefulness

- Improving token burn mechanisms 1 (80% of gas fees burned and 20% of gas fees for collectors)

- Implementing token burn mechanisms 2 (dApp staking V3)

- Equalizing EVM and Native Fees — currently, EVM fees are cheaper for dApps/Devs

- Creating a sustainable tokenomics model for long-term growth

- Adding value for holders

Addressing the second part of the equation: DEMAND

In addition to the technical aspects related to the development of a new tokenomics model, the most challenging part of the equation (DEMAND) is the crucial point that Astar intends to address. As the number one blockchain in Japan, Astar aims to achieve mass adoption along with the Japanese government’s aggressive strategies for leadership in Web3.

It’s Japan’s time!

It’s not news to the Astar community that Japan wants to lead the movement in Web3. The Liberal Party is increasingly taking steps to consolidate blockchain applications with real use cases. As the US tightens crypto regulations and China bans it, Japan may become the largest crypto economy. It seems it’s our time,” says Sota Watanabe.

- Astar Network x Fireblocks

- Astar Network x Seven Bank NFT ATM Distribution (26,000 ATMs in Japan)

- Startale Labs x Bank of Japan (CBDC)

- Sota Watanabe shared the stage with Joi Ito and Masaaki Taira at WebX_Asia in Tokyo from July 25 to 26, 2023, during a presentation of Japan’s strategy for Web3 in the next five years.

- The Prime Minister of Japan emphasized the importance of Web3 in transforming the structure of the Internet and modern society. The administration of Fumio Kishida is committed to promoting Web3 as a pillar of governance and a policy of development and innovation.

- The international recognition of Japan’s progress in relation to Web3 was mentioned by CZ (CEO of Binance), who confirmed the launch of a new platform in Japan in August.

- The #NFTTokyo2023 event sparked the interest of renowned industries like Sega and Konami in using NFTs to enter Web3 and solve real-world problems.

- Japan Blockchain Week 23 had over 30,000 participants, 1,000 speakers, and 300 presentations. Notable contributions included government involvement (Prime Minister Kishida and Minister of Economy, Trade, and Industry Nishimura).

Finally, it becomes evident that the nuances of each project and the distinct characteristics of each blockchain will shape tokenomics. There is nothing wrong with speculating and seeking profits in a highly volatile market from an investor’s perspective.

However, from a business point of view, the inherent use cases of each application demand different models to benefit the true users of the network. It is crucial for projects to carefully consider these aspects to ensure that tokenomics is designed to drive the utility of the token and the creation of genuine value for the users of the platform.

Reference

https://cointelegraph.com/magazine/tokenomics-manipulation-incentives-surprises/

Web 3. 0 enthusiastic - Polkadot & Astar Network ambassador

Welcome to the Pitcoin diary. Be prepared for an immersion in Polkadot, Kusama, and Astar Network ecosystem. Everything I write is my personal opinion - don't expect anything but chaos.

Polkadot Senior Ambassador and Astar Network all-star ambassador.

0 comments