TVL Reporting in Dotsama: An Uncertainty

For many investors, especially those braving the cryptocurrency frontier, Total Value Locked (TVL) is a key indicator of success of a Decentralized Finance (DeFi) project or protocol. Many keep a close eye on total value locked and factor this in their decision on whether to invest or not.

Before we dive any deeper, let’s define TVL.

It’s a combination of all the crypto assets deposited within a DeFi protocol including staking, lending and liquidity provision (pools/farming). Since it is a measure of the amount of crypto assets locked, deposits and withdrawals will naturally affect the TVL. Also remember, the price of the token locked in these protocols will change the TVL when we denominate in USD. We have all suspected this definition of TVL may or may not be used strictly by a number of protocols in Web3, but here it is. It is, however, undeniable that this measure is used as an indicator of overall success of a protocol by investors, businesses and media.

I hear it often

“That project is on fire! Man, look at the TVL!”

“Will it be the next 100x?”

“The TVL/MCAP is so low, it’s completely undervalued. Maybe I should buy now?”

This sentiment is common within Dotsama and I have observed it frequently in Web3, but there’s really one big question behind it all…how do we know if the reported TVL is true? Buried in this question lies a plethora of subsequent questions that surround this idea, especially in Polkadot and Kusama (Dotsama).

Within Dotsama, projects typically utilize Kusama parachain slots as a live testing ground to flesh out new and exciting protocols that are meant to be pushed to the limit. Many parachains, with heavy doses of DeFi, are already live today including Moonriver, Karura, Parallel Heiko and Kintsugi. While each of these platforms offer alternative experiences in terms of UI/UX, there are also a number of unique DeFi use cases that have drawn some intelligent degens to this space. What really sets Dotsama apart is that these parachains communicate through ultra-secure bridges, dubbed XCM, allowing for their native chain assets and liquidity to flow freely. This frequently transfers the liquidity of one parachain to the next. In ecosystems other than Dotsama, this would be a sign the protocol is losing steam.

Imagine millions in USD flowing from Terra to Ethereum as some new Uniswap innovation brings significant interest and promise of high APY previously unavailable on Terra. Comical, I know, but this is entirely possible and if liquidity flows from Terra to Ethereum, the TVL of Terra would naturally decrease and many would see this as a competitive advantage of Ethereum over Terra. This does become more nuanced with stablecoins such as DAI or UST, as these assets are native to Ethereum and Terra respectively and have propagated to the furthest corners of Web3 bringing more interest to these chains and stretching the tentacles of their reach and frequently bringing liquidity back to their chain; thus, increased TVL.

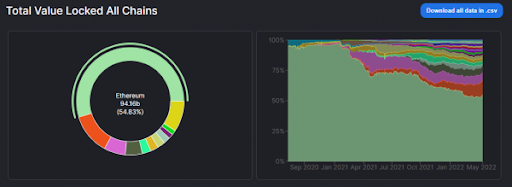

Over the course of 2021, there has been movement of liquidity out of Ethereum and into other protocols. This is visualized well on defillama.com. You can see how TVL has moved from almost exclusively within Ethereum (green) to Terra, Binance Smart Chain, Avalanche and Solana - in that order.

Source, DeFi Llama

Dotsama DeFi

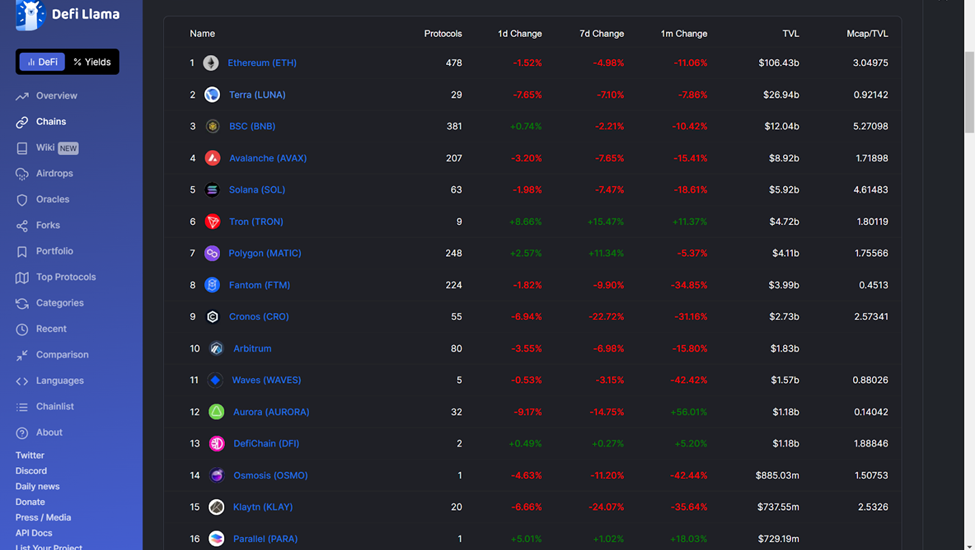

Now let’s dive right into Dotsama. Something I have noticed in reporting of TVL in Dotsama, apart from how TVL is calculated (that’s an entirely different article), is that it’s typically vastly underestimated, disjointed and simply falsely reported on reputable tools such as DeFi Llama.

Source, DeFi LlamaFor example, you can see here that the TVL of Parallel Finance is reported as upwards of 700 million USD and they are ranked at 16th, but the TVL of Polkadot is a mere 4.4 million and they are ranked at 82nd.

Source, DeFi LlamaParallels can be drawn for Kusama, but interestingly the TVL for Kusama is 104.7 million ranking it at 44th and higher than Polkadot. It appears this TVL is due to DeFi Llama incorporating BiFrost, which is a parachain within Kusama, as contributing the lion’s share of TVL.

Source, DeFi LlamaThis is a problem; you can’t have it both ways. Many legitimate DeFi-focused individuals, businesses and investors utilize DeFi Llama and TVL to decide where to invest. The health of a protocol is in many ways tied to liquidity within a protocol and the total value locked. With weak numbers such as those reported here, many, especially newcomers, would brush off the ecosystem after a quick look.

Shouldn’t DeFi Llama stay consistent in their reporting of TVL? Maybe this is a lack of understanding of how Dotsama works, but I’m not sure it is. Whatever the reason, I hope DeFi Llama reconsiders the way they are reporting these numbers. Let me give a few examples of ways TVL could be reported, and then give you an idea of what TVL within Dotsama actually looks like.

The Numbers

Source: https://defillama.com/chains

If you take the numbers for Kusama and Polkadot strictly from DeFi Llama here is how they shake out:

Sorted by Chain and Ranked by TVL

To give you an idea of where Dotsama ranks when compard to the top two in TVL, Ethereum and Terra

Ethereum - 106.7B (1st)

Terra - 27.46B (2nd)

Kusama - 105.4M (44th)

Polkadot - 4.4M (82nd)

Kusama’s Individual Chains

Moonriver - 223.22M

Bifrost (counted within Kusama) - 104M

Karura - 33.76M

Sora - 10.23M

Shiden - 644K

Kusama TVL = 371.85 Million USD (23rd)

Polkadot’s Individual Chains

Parallel - 726.77M

Astar - 332.08M

Moonbeam - 113.86M

Polkadot TVL = 1.17 Billion USD (14th)

With this set of data, you can see, there is a pretty significant difference between what DeFi Llama has reported as the TVL of Kusama and Polkadot and what the actual TVL is.

Kusama

TVL Difference: DeFi Llama = 105.4M v. Parachain Total = 371.85M

Rank: 44th -> 23rd

Polkadot

TVL Difference: DeFi Llama = 4.4M v. Parachain Total = 1.17B

Rank: 82nd -> 14th

Quite a significant difference. To take it a step further, I think we should combine TVLs of Polkadot and Kusama as there are many dApps that leverage both chains. With Zenlink, you can interact with Moonriver and Moonbeam within the same interface. While exchanging assets between these two chains within the dApp is not possible as of now, this feature will no doubt be integrated with either the incorporation of 3rd party bridges or completion of Kusama </> Polkadot bridge.

Apart from dApps, the flow of assets is natural between these two chains, and the silos between them are much softer than those between most other chains. They’re sister networks and the teams that build these chains are one in the same.

*So how about we combine them? *

Dotsama TVL = 1.5 Billion USD which would rank Dotsama as 12th

This is all before XCM is fully live, Terra is brought in, Wormhole is incorporated and Uniswap v3 deploys (voting begins today). There are surely more opportunities actively being developed as you read this article.

From the Chains

Finally, I wanted to see how DeFi Llama’s reporting of TVL compares to the parachains self reporting of their TVL at the time of writing. This research ended up incorporating Acala and significantly increasing the TVL of Polkadot, although it did not move up the ranking very much.

Kusama’s Individual Chains

Moonriver - 207.3M

BiFrost - 104.7M

Karura - 65.29M

Shiden - 13.1M

Sora - 10.23M

Genshrio - 8.4M

Heiko (reported in Parallel total)

Kintsugi - 2.11M

Kusama TVL = 411.13M (21st)

Polkadot’s Individual Chains

Acala - 497.76M

Astar - 983.8M

Parallel - 727.4M

Moonbeam - 131M

Centrifuge - 84.27M

Polkadot TVL = 2.42B (10th)

As above, let’s combine Polkadot and Kusama’s TVL when gathered from parachain's self reporting on their dApps. This would put Dotsama’s TVL at 2.83B which would rank it as 9th in TVL.

This is a much different picture than what is painted by one of the most reputable reporting tools in the space. I hope this has been as eye opening to you as it was to me. As Dotsama’s DeFi season starts up with the development of novel use cases, it will be interesting to evaluate how the DeFi world views this burgeoning chain.

Now a few questions for you to think over. What about how TVL is reported? Do chains do this well? Should we actually report TVL under the umbrella of Dotsama? What about liquid staking derivatives, how should they be counted? Let me know your thoughts in the comments below.

Tips appreciated:

KSM:

- GL85fwNiFfUqkCcmtrq7eD5DphB1QWJrxkgMme5qdSuFfap

Polkadot Eco Enthusiast, follow for insights on connecting the DOTs, shitposts, and general shenanigans

A streamlined beginner's guide for you to learn about everything Polkadot has to offer. From how-to guides, NFT learning, technical developments and more, we've got you covered. Want to post something educational you think will help newcomers, please feel free!

0 comments